Nowadays many people are showing interest in Binance trading and many are not able to enter this sector and see the face of success due to lack of proper guidelines. Also, some people with little knowledge around are spoiling the interest by misinterpreting it and presenting it terribly.The first thing is, if you don't have an account on Binance, then signup on Binance from this link and verify it by watching a YouTube video.

You can see the face of success in trading if you understand how every part of spot trading works. If you don't have idea then sitting all day will not gain a single penny. Remember that since you will be trading with money, you must be aware of losses. If you don't want to take loss then go full stop here. The rest of the post is not for you.

I have not found any Bengali article on spot trading or perhaps no one thought it necessary to write. So I am writing for you guys and definitely share it with your friends. Many will benefit from it. Since this is only for beginners, there is nothing here for the experienced. So if there is any mistake in the writing, please let me know and I will change it.

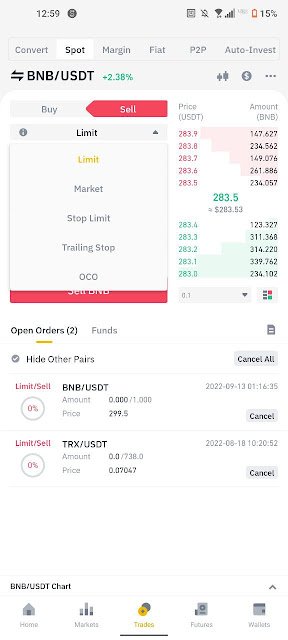

There are some procedures for spot trading. For example: Limit, Market, Stop Limit, OCO, Trailing Stop. Let's know how each of these parts work -

.jpg)

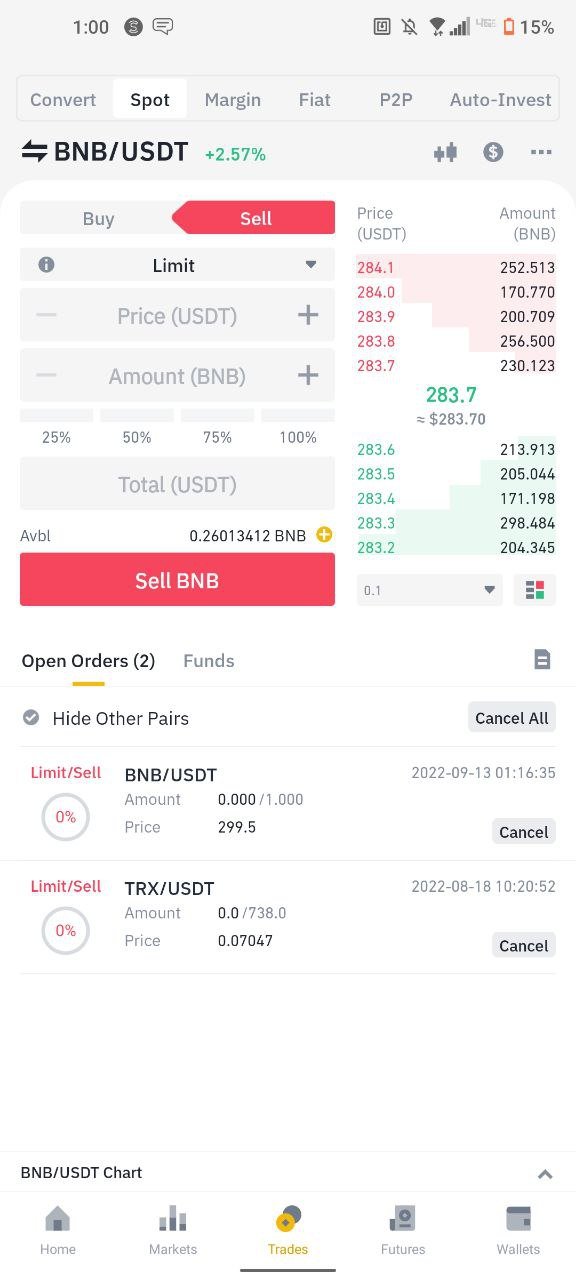

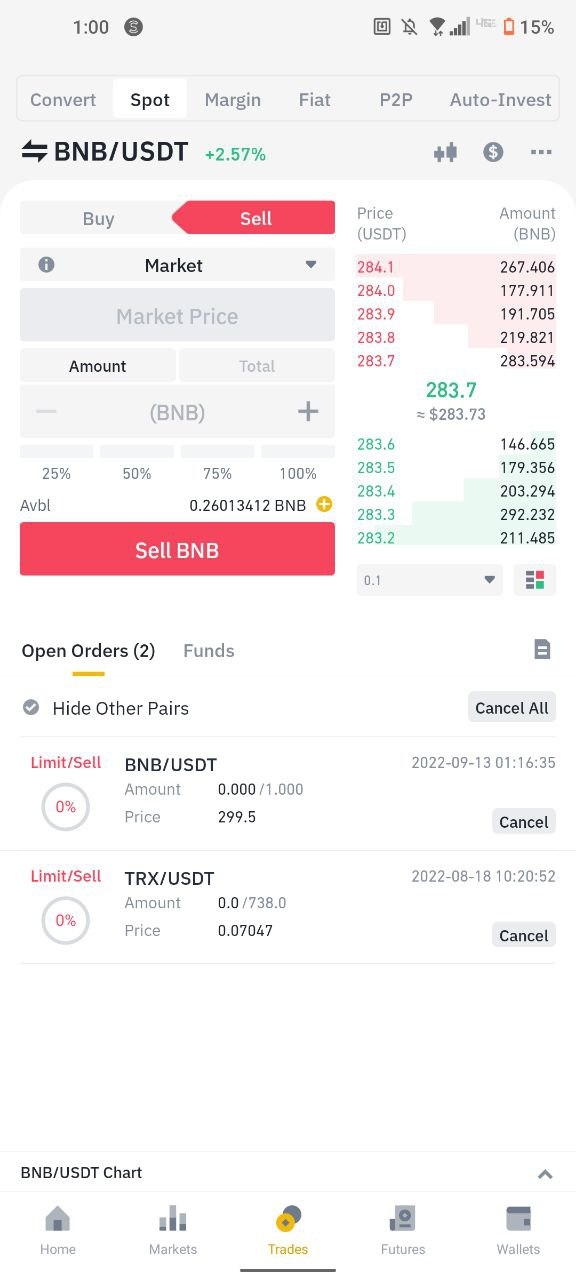

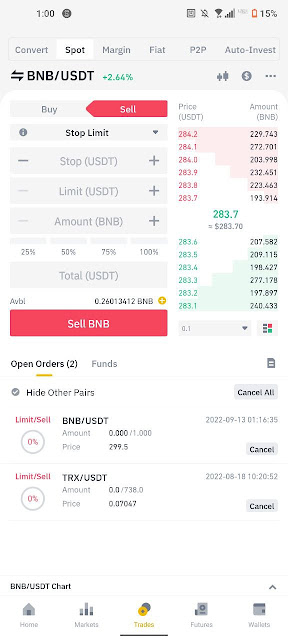

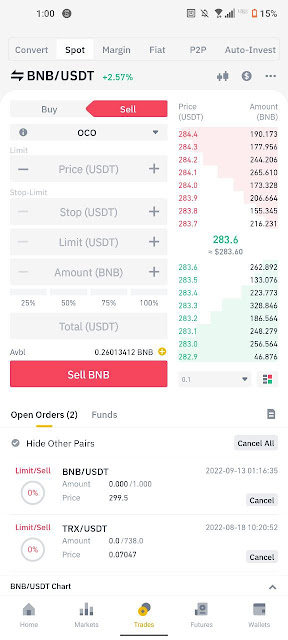

I forgot to mention another thing. That is, many of the parts are explained in the video, so I am not writing them here. Only the main points are mentioned here. I chose the BNB/USDT pair to illustrate these points. And the current price in the picture is $283.7.

.jpg)

Limit: As seen in the above image, Price (usdt) and Amount (BNB) are shown. When do you use limits? If you have extra dollars lying around that you don't need right away, you can use it. Suppose, the current price of BNB dollar is 283 dollars. You bought 1 BNB at this price. You want to sell it at $290 or sell it at your desired profit. So come to the limit option and write 290 dollars with your profit in the Price (usdt) box and if you select 100% in the Amount (BNB) box and mark Sell BNB, an order will be deposited in the Open Order box. In the above picture you can see that two orders of BNB and TRX have been deposited. When the price of BNB in the market increases and crosses 290 dollars, then automatically your BNB will be sold and dollars will be accumulated in the balance. The balance will be added in the currency in which you purchase BNB. I have used USDT here so the balance will be credited there. In this way you are getting 5 dollar profit. And if for some reason the market goes down instead of up, there is nothing to be disappointed about. Because as I said before it is your extra money with which you bought this BNB. So even if the price falls, don't worry, dude, sit. The price will increase again. And the price of a currency fluctuates 7-8 times in a month, so there is no need to sit with money. If you want to trade for a long time or think that you will buy a token cheaply and hope for a higher price, then you can also trade through this medium.

Market: If you want to buy or sell a token quickly according to the market rate, then select the market and work. By doing this, you can sell at the rate that will be shown as the current rate. However, since the market moves less than every second, it is necessary to sell at a slightly lower price or buy at a higher price than what the rate will show. If you want to sell BNB at the rate of 283.7 dollars, you will see in the history that you will get 283.5 dollars as soon as you place the sell order. So if you buy and sell using limit option then buy and sell will be done at the price you give.

Stop Limit: This option is mainly used to reduce the loss. See in the above image Stop (usdt), Limit (usdt), Amount (bnb) is visible. And the current BNB rate appears to be $283.7. Suppose, put 280.5 in the Stop box and 275.1 in the Limit box. What does this mean? If you see that the market is going up and down and you fear that the loss will be high, then you put 280.5 in the stop box. That is, even if you lose 3.2 dollars it will not be a problem or you can afford to accept it. And gave 275.1 dollars in the limit box. That is, if the BNB of 283.7 dollars loses up to 275.1 dollars, then you can pay the maximum discount. This will make you lose $8.6 if it is too high. You don't want to lose more than that. Try to understand better now, it was seen that the price of the dollar dropped from 283.7 dollars to 280.5 to 278 dollars. Since you have given limit 275.1 your dollar will not be sold at loss. Again it was seen that the price of the dollar reached 275.2 and went up again without going down 0.1. This will save you from loss. Since you set the limit as $275.1, even if it comes close to a little less than that, the dollar will not be sold. If somehow it comes from 275.1 to 275.0 then the dollar will be sold. They become a bit risky. Only if you agree to accept the amount of loss can you give a limit like this. But you need to have the ability to do market fundamental analysis. There is no profit in guessing the price. Loss will be more than profit. So learn well and then set such a stop-limit. Otherwise, enter the same amount of numbers in both the Stop and Limit boxes. By doing this, when the dollar reaches that price, it will be sold and saved from additional losses.

OCO: Most traders work using it. How does it work? Above image shows Price (usdt), Stop (usdt), Limit (usdt), Amount (bnb) and current price is $283.7. Suppose you bought BNB for $283.7. You want to sell the dollar when it hits $290.7. Suppose, you agree to a maximum of 280.7 if you lose. I do not agree under this. Now let's set the box. Enter $290.7 in the Price box, which is marked as your profit. Set 280.7 dollars in the Stop and Limit boxes and select the sale by setting the whole dollar to 100% in the Amount box. It will become an open order. Now if the market hits 290.7 then auto sell will be done and profit and original price will balance. And if it goes down to 280.7 then it will be sold. By doing this, only 3 dollars will be lost. And if you think that your father will cheat you, then put only 283.7 dollars in the stop and limit box. By doing this, if the market goes down, the price at which you bought it will be sold at the same price. You'll get a few cents less because each trade takes a very small amount of dollars. Its quantity is very small, it does not affect us. I hope you are reading and having fun because you understand that this is more of a milky subject than calculus. Yes, it is a simple matter but to understand the market one must have analytical skills. You will benefit more by doing this. When to trade, when not to trade. When will it be good to take entry? For these you need to understand the market. For which Antut will need to stick like a donkey for 6 months. Only then this spot trading will give you full profit.

OCO: Most traders work using it. How does it work? Above image shows Price (usdt), Stop (usdt), Limit (usdt), Amount (bnb) and current price is $283.7. Suppose you bought BNB for $283.7. You want to sell the dollar when it hits $290.7. Suppose, you agree to a maximum of 280.7 if you lose. I do not agree under this. Now let's set the box. Enter $290.7 in the Price box, which is marked as your profit. Set 280.7 dollars in the Stop and Limit boxes and select the sale by setting the whole dollar to 100% in the Amount box. It will become an open order. Now if the market hits 290.7 then auto sell will be done and profit and original price will balance. And if it goes down to 280.7 then it will be sold. By doing this, only 3 dollars will be lost. And if you think that your father will cheat you, then put only 283.7 dollars in the stop and limit box. By doing this, if the market goes down, the price at which you bought it will be sold at the same price. You'll get a few cents less because each trade takes a very small amount of dollars. Its quantity is very small, it does not affect us. I hope you are reading and having fun because you understand that this is more of a milky subject than calculus. Yes, it is a simple matter but to understand the market one must have analytical skills. You will benefit more by doing this. When to trade, when not to trade. When will it be good to take entry? For these you need to understand the market. For which Antut will need to stick like a donkey for 6 months. Only then this spot trading will give you full profit.

OCO: Most traders work using it. How does it work? Above image shows Price (usdt), Stop (usdt), Limit (usdt), Amount (bnb) and current price is $283.7. Suppose you bought BNB for $283.7. You want to sell the dollar when it hits $290.7. Suppose, you agree to a maximum of 280.7 if you lose. I do not agree under this. Now let's set the box. Enter $290.7 in the Price box, which is marked as your profit. Set 280.7 dollars in the Stop and Limit boxes and select the sale by setting the whole dollar to 100% in the Amount box. It will become an open order. Now if the market hits 290.7 then auto sell will be done and profit and original price will balance. And if it goes down to 280.7 then it will be sold. By doing this, only 3 dollars will be lost. And if you think that your father will cheat you, then put only 283.7 dollars in the stop and limit box. By doing this, if the market goes down, the price at which you bought it will be sold at the same price. You'll get a few cents less because each trade takes a very small amount of dollars. Its quantity is very small, it does not affect us. I hope you are reading and having fun because you understand that this is more of a milky subject than calculus. Yes, it is a simple matter but to understand the market one must have analytical skills. You will benefit more by doing this. When to trade, when not to trade. When will it be good to take entry? For these you need to understand the market. For which Antut will need to stick like a donkey for 6 months. Only then this spot trading will give you full profit.

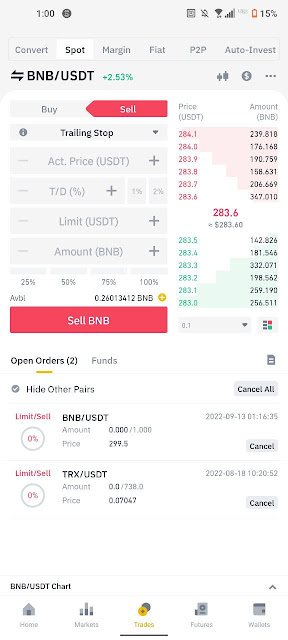

Trailing Stop: This is the advanced version of OCO. If you have experience with futures trading then you have seen it there and everyone is familiar with it in Forex. But it is completely new in spot trading. It has been a few months. And more than 90% people in the market do not understand it. But you will understand now.

Suppose, a token came in the market yesterday. You saw it cost $1 in the evening. You think once you buy it for 50 dollars, sell it if it is 60 dollars. 10 dollars will be profit. You sleep at night and pick up your phone in the morning to see that the price has gone up to 400% overnight but you only got $10 profit whereas if you were awake it would have jumped $50 to $400. You spent the whole day regretting it.

Binance doesn't want you to regret it more and more. So it has appeared. As seen in the above picture, Act. Price (usdt), T/D (%), Limit (usdt), Amount (bnb) and current price is $283.6 and 2.53% is seen above the sell box.

Suppose, Act. Price = 285.6

T/D = 2.5%

Limit = 280.5

Here, the active price is $285.6. The trial will begin when the dollar rises to $285.6. Just like when we go to the market, we try on clothes one by one. Here 2.5% is the price increase rate. Suppose the price rises from $283.6 and hits $285.6 and the trial begins. And the price increased by 2.5% from 285.6 to 290.5 dollars. 290.5 again increased by 2.5% to 296.0 dollars. Again 2.5% increase to 300.5 dollars. Note here that our price hit $300 with a 2.5% increase from $283.6. Now, if the price does not increase further, whenever the price drops by 2.5% and the price drops to $298, dollars will be sold and deposited into the balance. I guess, the market never went down, it went to $500 and finally down 2.5% to $495. Immediately the dollar will be sold and credited to your account.

Suppose, the price increased from 283.6 at the rate of 2.5% and every time the price increased to 290, 300, 325, 330, 350, 400, 425. Here each number is a trial stop. If it comes to any of the stops, it would be reduced by 2.5%, then you will get the rate after the reduction.

Suppose again, he bought with 283.6 dollars but the market started going down instead of going up. And whenever it goes down 2.5% to $280.5 then sell it and cut your loss.

Now which medium to start trading will depend on your skill. Come to our Telegram group, here we will discuss every topic and you will trade according to your position. But remember, trade is risky so do everything in your own mind, don't be influenced by someone's words. If you can learn properly then it will not be possible to spend time on anything else because you can earn good income from here. How much income can be made, check Telegram yourself.

The group is for beginners only. Nothing here for experts. So it is better not to waste time unnecessarily.

0 Comments